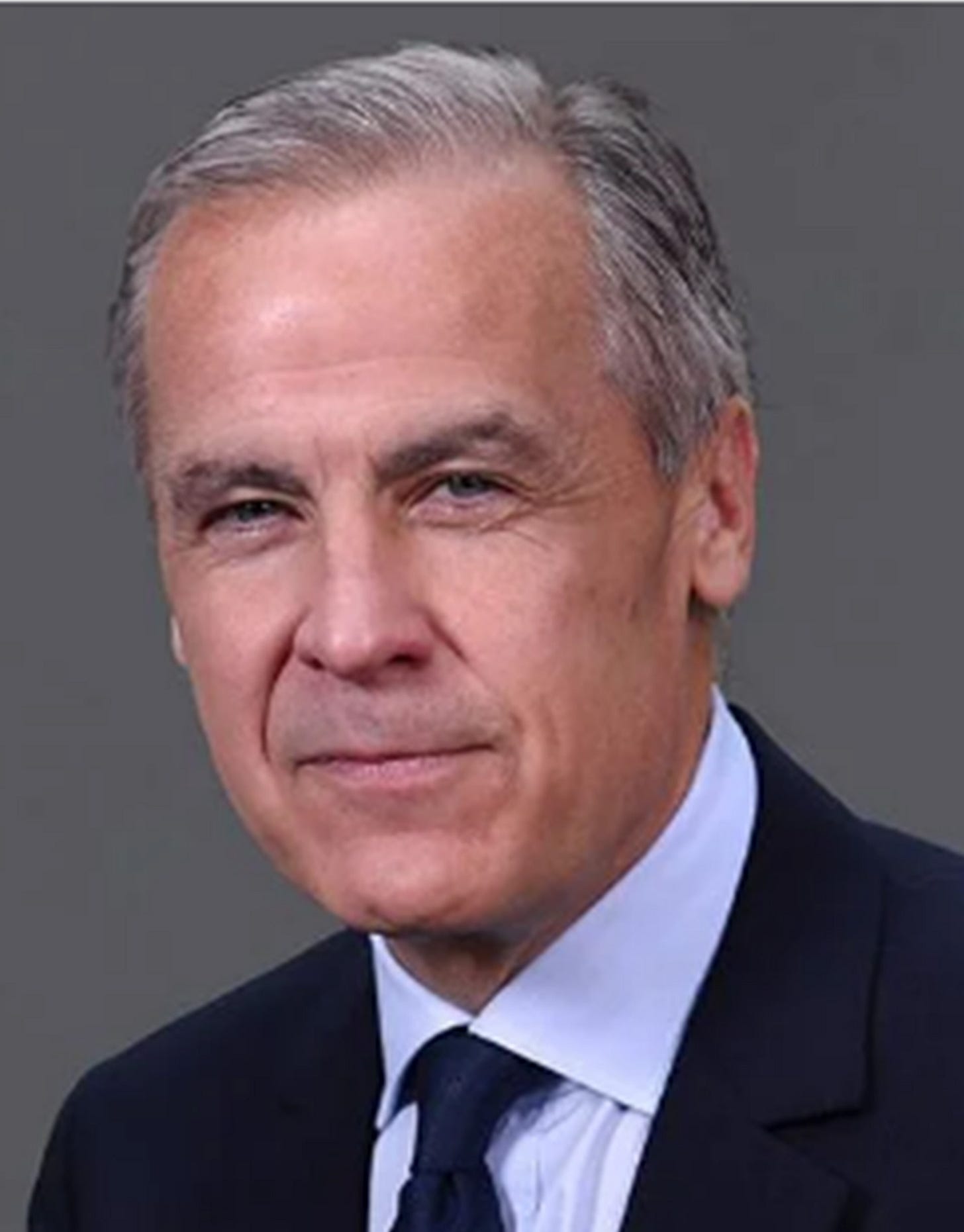

Last week, another scandalous and potentially corrupt string of federal activities popped up. This one has profound implications for pension plans in Canada, including the debate about an Alberta Pension Plan. Mark Carney’s double game of politics and profit enhances the drive to patriate Alberta’s pension wealth.

At issue is a report in the media saying that Brookfield may be looking to raise a $50 billion fund with contributions from Canada's pension funds and an additional $10 billion from the federal government.

This report has drawn significant attention for several reasons. Toronto-based Brookfield is one of the world's largest alternative investment management companies, claiming about one trillion in assets under management. Their portfolio spans real estate, renewable energy, infrastructure, and private equity, making them a significant player in domestic and international markets. The magnitude of Brookfield's investments places them at the forefront of global financial movements, giving considerable weight to any fund they propose to establish.

The second reason is that Finance Minister Chrystia Freeland and Prime Minister Justin Trudeau have voiced their ambitions to boost home-grown investments. One of the government's strategies includes tapping into Stephen Poloz, the former Governor of the Bank of Canada. Poloz succeeded Mark Carney as the head of the bank. The Liberal government has tasked Poloz with leading a working group to identify "incentives" that would “encourage” institutional investors to keep their capital in Canada.

Moreover, Finance Minister Freeland has suggested implementing new regulations to ensure that more of Canada's substantial pension fund reserves, which amount to an impressive $1.8 trillion, are allocated toward Canadian ventures. This comes when a staggering 73% of Canadian pension funds are invested abroad.

On its face, a plan to invest more Canadian wealth in Canada might sound reasonable. However, the plan avoids the crucial question of why money experts prefer investing outside Canada. Considering that question, one must consider the Trudeau government's economic record.

Put differently, Ottawa is looking for ways to compel large pools of Canadian money to be invested in Canada instead of allowing investment funds to find the best return for Canadian investors. Those large cash pools, such as teachers' pensions, typically belong to hard-working Canadians. They would be forced to earn less for their pension money.

Forcing such large sums to remain in Canada would mask the continuous slump in productivity in the Canadian economy.

Keep reading with a 7-day free trial

Subscribe to Haultain Research to keep reading this post and get 7 days of free access to the full post archives.